Companies develop a chart of accounts as the first step toward setting up. Amount due To Directors CR.

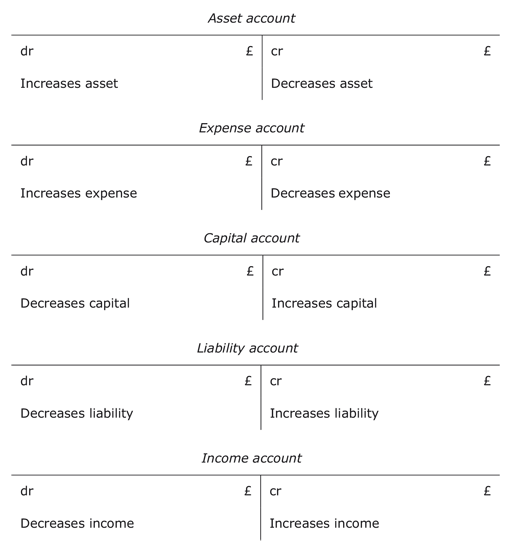

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

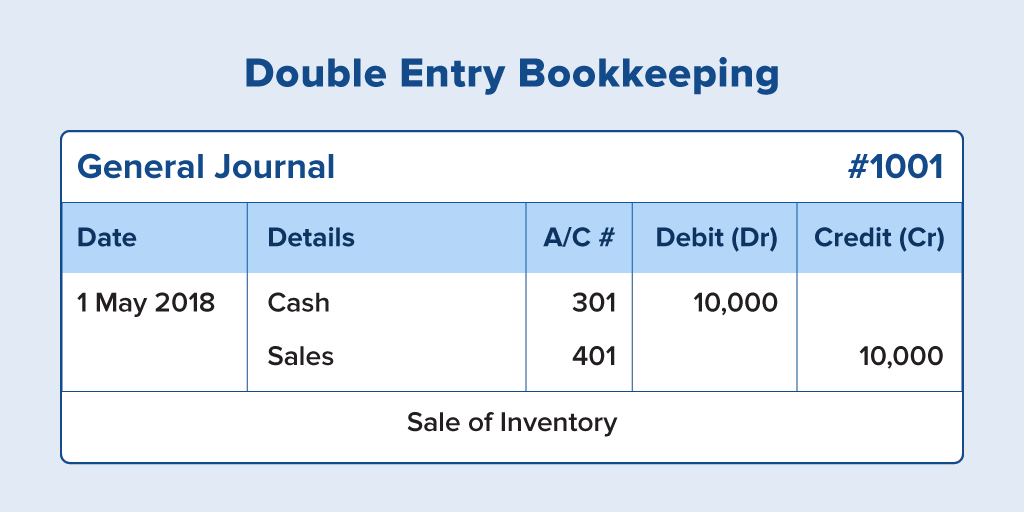

Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts.

. We need to present value the amount due to Directors since the Directors are financing the Company. Individual Loans written-off. DEFERRED TAXATION The annexed notes form an integral part of these financial statements.

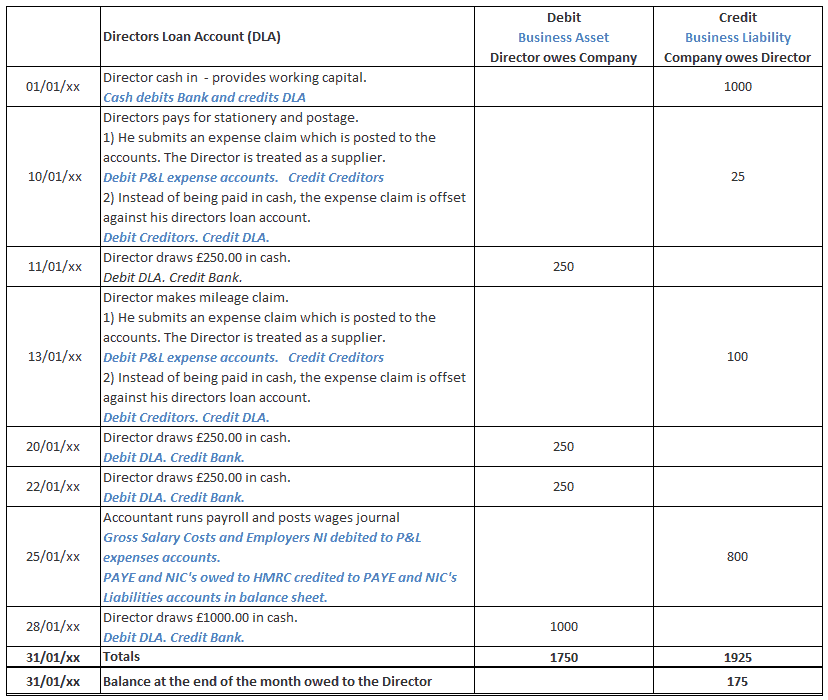

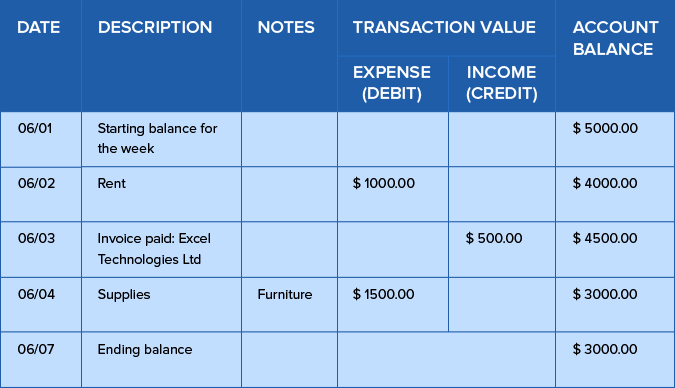

Cash in cash out. They put the money in the bank account. Overdrawn DLA at Year End.

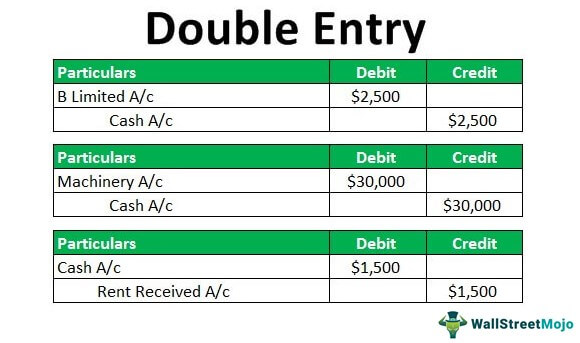

Under IFRS for SME - Para 1113 If the arrangement constitutes a financing transaction the entity. Double Entry for Directors Loans. Here is how the entries were posted in the double entry system of accounting on that particular date.

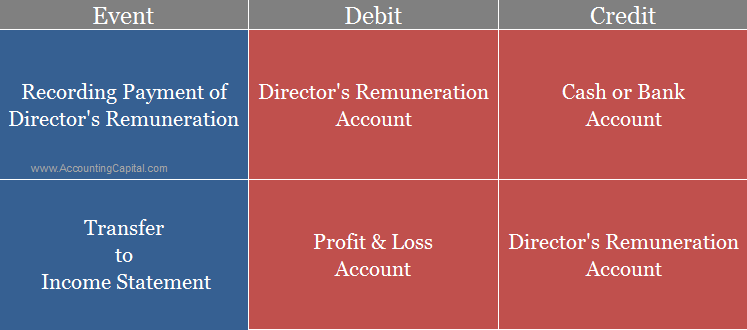

Leaving a net amount due of 800 1000 200. On 01 April the company has approved the remuneration package even the payment does not complete yet but we have to. This is the representation of the debtors that the company has at a given.

You pay a credit card statement in the amount of 6000 and all of the purchases are for expenses. Firstly to understand this U should know the difference between transaction and event. The entry is a total of 6000 debited to several expense accounts and 6000.

If the loan was made to an unquoted trading company the individual will crystalise a capital loss equal to the amount of the loan written. In addition on the same side of the equation the expenses of 200 decrease the net income retained earnings and therefore owners equity in the business by the same amount. The director may loan the company 1000 to pay a supplier or cover working capital requirements.

Please prepare the journal entries for the remuneration package. Event - it is a consequence or result of the transaction. He may also pay for several items of stationery and postage on behalf of the company using his own cash.

Company 1 purchases goods from Company 2 on account credit. If we run a payroll for you of say 125000 gross equating to 100000 net which you should pay yourself the 100000 salary due creates a credit in the Director Loan AccountDLA until such time that your company pays yourself the salary to show that the company still owes you as the director 1000. Hence we have present value the amount due to Director at zero value.

Under the accrual method of accounting the above transaction will be. It is the basis for modern bookkeeping. Company 2 will record the sale as due from account and Company 1 will record the purchase in the due to account as they have yet to pay Company 2.

Answer 1 of 6. In this case one balance sheet liability account employee reimbursement has been increased by 200 reflecting the amount due to the employee. The repayments I am recording as obviously the one credit the sum of the two debits.

AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. 1100628-TIncorporated in Malaysia 14 NOTES TO THE FINANCIAL. Director loan write off double entry.

The director has been returned 79K already. CASA FOREST BIO WOOD MANUFACTURING SDN. This is because the company has already serviced this order in terms of processing the relevant goods and services.

Pay an employee 5000 and you end up with 595000 100000 495000. A director lent 100K into a firm but the firm is always in loss and can only reply 79K. Credit that is due from customers is considered to be a current asset.

Let us consider the following example to understand the double entry bookkeeping process. Dan booked an office table for his new set up at 2000. Popular Double Entry.

The double entries is as follows. Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period. OK so the directors of a company have taken out a loan themselves that is used only for business purposes as they were unable to raise the money any other way.

Overdrawn directors loan accounts is effectively an interest-free loan to the director and can have quite complex tax implications. He paid 1000 in advance and 1000 was due upon delivery after the table was ready. This high-level equation is a summary of all the accounts that a double entry system uses.

The amount due from the customer has been posted to the accounts receivable ledger whereas the amount due to the supplier is posted to the accounts payable ledger. Transaction -any economic activity which results into change in financial position of the entity. The amount needs to be paid back in 15 days.

On 20 April the company has made a payment of 50000 to all directors. The DLA is a combination of cash in money owed to and cash out money owed from the director. If an individual makes a loan to a company and this is subsequently written-off the company will have a non-trading loan relationship credit equal to the amount written off.

The amount that is due from customers is also referred to as Accounts Receivable. Purchase sale etc. The business has agreed with the customer that the balances are to be offset by contra entry.

Double Entry Accounting Accounting Basics Learn Accounting Bookkeeping And Accounting

Loan Repayment Principal And Interest Double Entry Bookkeeping

General Journal In Accounting Double Entry Bookkeeping

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Gnucash And Double Entry Accounting Example Business Rocketscience Llc

Double Entry Definition Examples Principles Of Double Entry

Journal Entries For Transfers And Reclassifications Oracle Assets Help

What Is A Directors Loan Account Caseron Cloud Accounting

Dividends Payable Classification And Journal Entry Debit Credit

Introduction To Bookkeeping And Accounting 2 5 T Accounts Debits And Credits Openlearn Open University

Double Entry Bookkeeping System Business Finance

Double Entry Bookkeeping System Business Finance

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

Double Entry Accounting Type Of Accounting Zoho Books

Difference Between Single Entry System And Double Entry System Zoho Books

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Journal Entry For Director S Remuneration Accountingcapital

The Accounting Equation And The Principles Of Double Entry Bookkeeping